What to Do When Your Portfolio Faces A Virus

Posted March 10, 2020

Imagine driving down a steep, windy road and losing your brakes. Maybe you’ve had this nightmare? You start pumping the brakes over and over in hopes of regaining control. That’s close to what it feels like to be an investor in today’s market environment. So far, the markets in March have been on a roller-coaster ride with drops of anywhere from 700 to 1,000 points daily. Most of the slide is coming from fear that the Coronavirus would stall global growth as a result of quarantines. Economists are also worried about lower earnings and consumer spending from travel bans and work stoppages. The result, many analysts worry, would be an anemic economy.

Then, just as the markets were adjusting to Covid-19 came news that Saudi Arabia and Russia were ditching a joint plan to cut oil production in order to keep prices and supply stable. The result? Oil prices dropped 20% in just one day. The chart below shows the price of Brent crude, now well off its high set in 2018.

Talk about throwing fuel on the fire. Given the market’s sensitivity over the last few weeks, it’s easy to see why it went into a full-blown spasm. Here are some of the takeaways for the trading day that was March 9, 2020, also known as “Black Monday”:

- The Dow Jones Industrial Average plunged 2,013 points to close at 23,851.*

- Volatility in trading caused circuit breakers to kick in, halting trading.

- The 10-year Treasury fell below 0.5% before climbing back to 0.57%. **

- The 30-year yield dropped under 0.9% taking the US yield curve below 1% for the first time ever.***

What can you do to regain control?

It’s hard to think rationally during moments like these, but amidst the chaos there can be opportunities. Consider that the stocks of some companies with good balance sheets might be on sale. A 30-year mortgage could be cheaper than it was a few years ago. Depending on your needs, goals, and time horizon now may be a good time to look for opportunities.

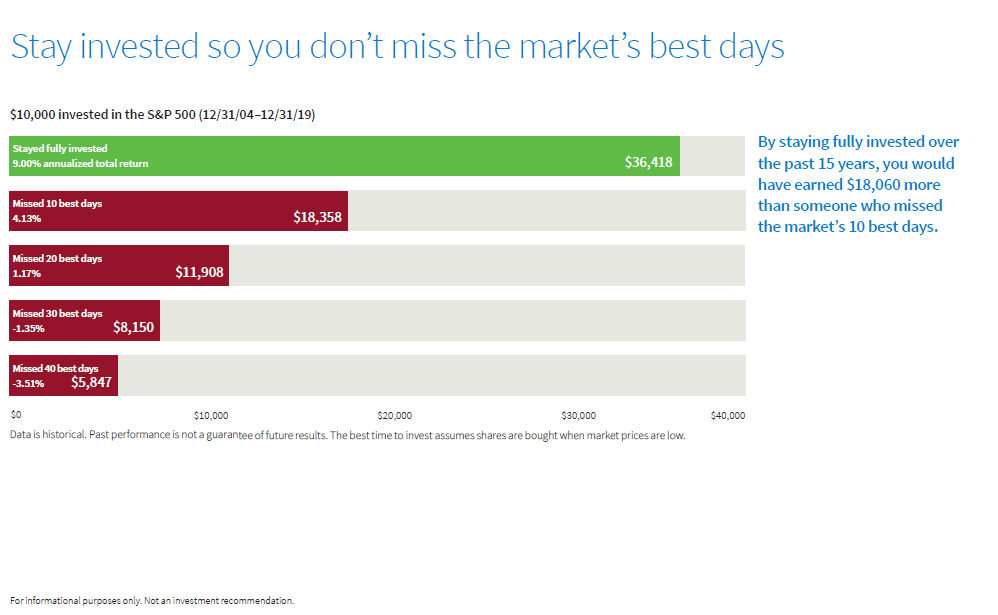

What should you not do? Panic. At times like these, selling out and moving into safer investments is a fool’s errand. Consider the research of Putnam Investments which studied data from 2003-2018 and found if you were fully invested in the S & P 500 during that time, your annualized total return was 7.7%. But if you missed the 10 best days in the market, it dropped to a negligible 2.65%.

*Marketwatch.com for March 9,2020 ** https://www.bloomberg.com/news/articles/2020-03-08/yen-slides-as-oil-price-war-adds-to-global-worries-markets-wrap

Can history be a guide?

While past performance does not predict future results, we can look in the rearview mirror of investing and anticipate that the ride can get smoother after these kinds of corrections. The key is to stay focused on your financial plan and its goals. As hard as it may be right now, it may be prudent to follow your financial road map.

By the way, if you need a sounding board, we’d be happy to listen and work through your concerns.

Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is no guarantee of future results.

Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.

The article is for informational purposes only and is not intended to be used as a general guide to investing or financial planning, or as a source of any specific recommendations, and makes no implied or express recommendations concerning the manner in which any individual’s investments or assets should or would be handled, as appropriate strategies depend upon each individual’s specific objectives. It is the responsibility of any person or persons in possession of this material to inform himself or herself of, and to seek appropriate advice regarding, any investment or financial planning decisions, legal requirements, and taxation regulations which might be relevant to the topics this article, or the purchase, subscription, holding, exchange, redemption, or disposal or any investments.

All indices are unmanaged and investors cannot actually invest directly into an index. Unlike investments, indices do not incur management fees, charges, or expenses. Past performance does not guarantee future results.

Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is no guarantee of future results.

Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.